The importance of agriculture in economic development cannot be overstated. Despite the strategic place that agriculture occupies, many financial institutions are unable to extend necessary support as a result of some gaps that need to be closed, if this sector is to remain relevant in the scheme of things in the country. The webinar series are designed to educate the Nigerian business and legal communities on matters affecting the local business environment, and how to navigate the terrain with ease.

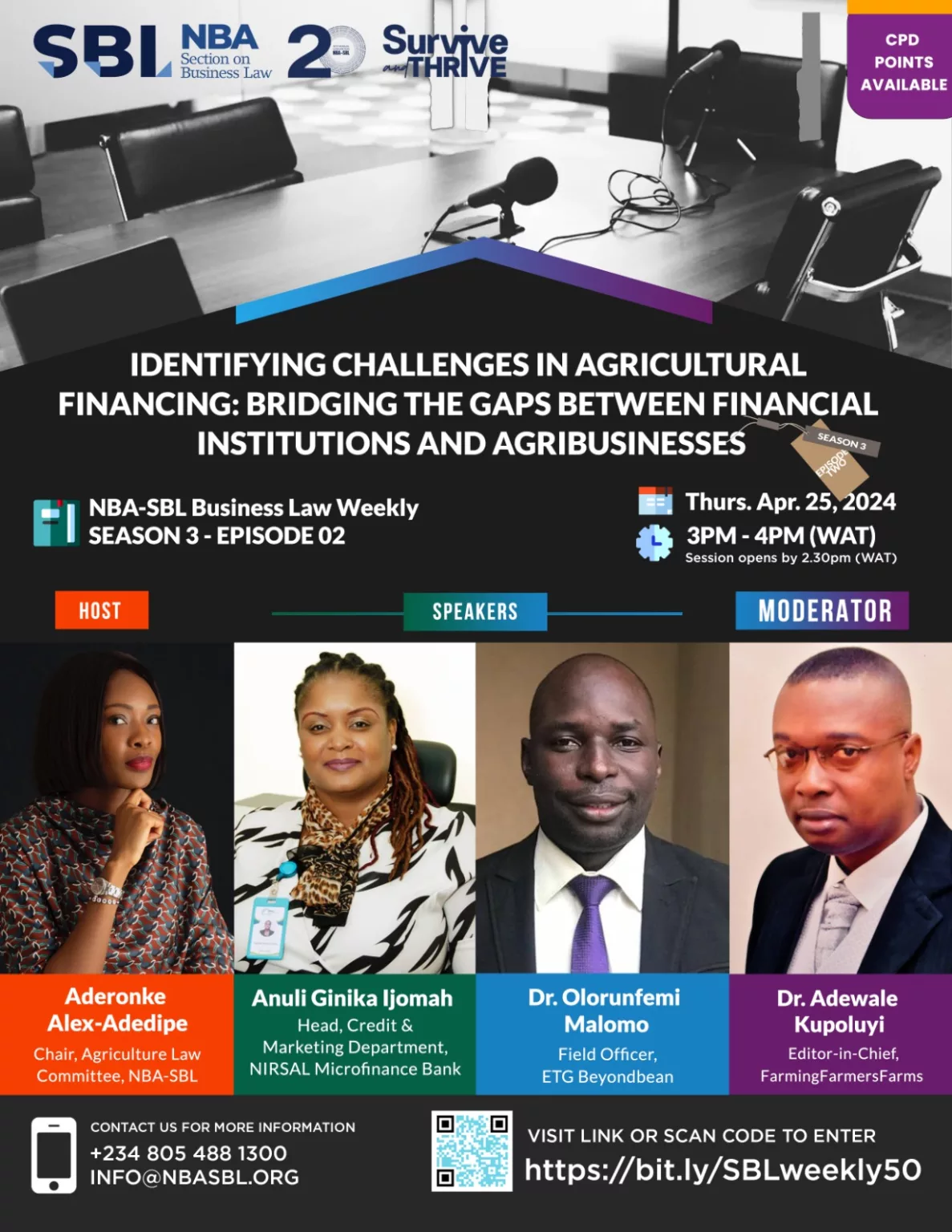

This is the position of panelists during the Nigerian Bar Association Section on Business Law (NBA-SBL) Business Law Weekly Season 3, Episode 2 with the theme: “Identifying Challenges in Agricultural Financing: Bridging the Gaps between Financial Institutions and Agribusinesses”, which was put together by the NBA-SBL Agriculture Law Committee. The discourse was moderated by the committee’s Secretary and Editor-in-Chief of FarmingFarmersFarms, Dr. Adewale Kupoluyi, and hosted by the section’s Chair, Aderonke Alex-Adedipe, who was represented the Vice Chair, Joshua Daranijo.

According to the Head, Credit and Marketing Department of NIRSAL Microfinance Bank, Anulika Ijomah, what should be done to change this narrative of not funding agribusinesses properly is to make governments at all levels to give banks soft landing such that loans can be quickly and easily disbursed to farmers and the issue of collateral is resolved. She said that ministries of agriculture should handle extension services and properly train farmers for them to understand agriculture as a business and not seen as mere farming exercise. Ijomah informed that the Nigerian Agricultural Insurance Corporation (NAIC) was set up specifically to provide agricultural risks insurance cover for Nigerian farmers, adding that the government must subsidise farm mechanisation and adequately monitor farmers from the first day of farming up to the moment of harvesting.

The NIRSAL official called for wider conversations between the government and all parties involved in agricultural financing, noting that the required resources had to be provided, and suppliers certified while the issue of insecurity is urgently tackled. She revealed that her bank was ready to assist prospective clients in processing their loans and also do follow-ups after disbursements. She noted that “There is need for wider conversation with government and all parties involved in the agribusiness should be duly informed and there should be proper monitoring of farmers from the first day of production to the point of harvest with subsidised mechanised farming. Our product can align with every phase of agricultural value-chain, but depending on the farmer’s behaviour and they should present their proposals well for them to finance. Lack of knowledge, cost implication and monetary evaluation are some of the issues farmers are facing”.

Ijomah, however, urged fresh starters in agribusiness to understand how the venture works, saying they must devote their valuable time for the business because of its delicate nature. They should equally have their markets and be sure of what they want to do. Reeling out some of the problems of funding agricultural businesses, the panelist pointed out major ones to include insurance coverage, inability of farmers to manage disease, land leasing, inferior quality of farm inputs, global warming and inadequate collateral, among others. On his part, the Field Officer, ETG Beyondbeans, Dr. Olorunfemi Malomo has made a case for synergy between NIRSAL and the National Orientation Agency (NOA), adding that the agripreneur should be well-informed on available opportunities. He posited that communication was key, adding that farming products should be made affordable and accessible to agripreneurs at the grassroots, saying that the products provided by microfinance banks should be insured.

“We should get rid of organisation bottlenecks as they affect agricultural production. There is a gap between financial institutions and agribusinesses and that many farmers are yet to identify where to get loans or grants. Farmers should be keeping records to make it easy for them to access loans from financial institutions, they should do feasibility studies, engage experts, and know the available resources”, he added. Dr. Malomo revealed that Nigerians love too much of imported goods, saying they should rather change this disposition and patronise locally-made goods in order to help the economy, noting that undue organisational bottlenecks should be look into such that loans can be quickly disbursed to farmers with stern warning to prospective agripreneurs to have funds that would cater for the whole agricultural cycle, saying if funds were not available, they should not bother to start the business at all.

In summary, the parley was really a worthwhile effort that has gone a long way in identifying challenges in agricultural financing in a bid to bridging the gaps between financial institutions and agribusinesses. Getting this done and turning things around would happen when governments at all levels give banks soft landing to make credits to be disbursed to farmers with little or no collateral, when ministries of agriculture handle extension services and properly train farmers to understand agriculture as a business, subsidising farm mechanisation, better monitoring of farmers, making starters in agribusiness to understand how the business works, enhanced communication with farmers as well as patronising agricultural insurance, to mention a few.

The Nigerian Bar Association comprises three professional practice sections, viz: Section on Legal Practice (NBA-SPL), Section on Business Law (NBA-SBL), and Section on Public Interest and Development Law (SPIDEL). The practice sections are designed to equip NBA members with necessary skills for the advancement and exploits in the legal profession. The NBA-SBL was established 20 years ago and has at its apex, a council that is currently chaired by a seasoned lawyer and Managing Partner, Odujinrin & Adeoye, Dr. Adeoye Adefulu with other members in sector-focused committees, such as the Agriculture Law Committee that were established to cover existing and new areas of law with a view to enhancing commercial law practice in Nigeria.