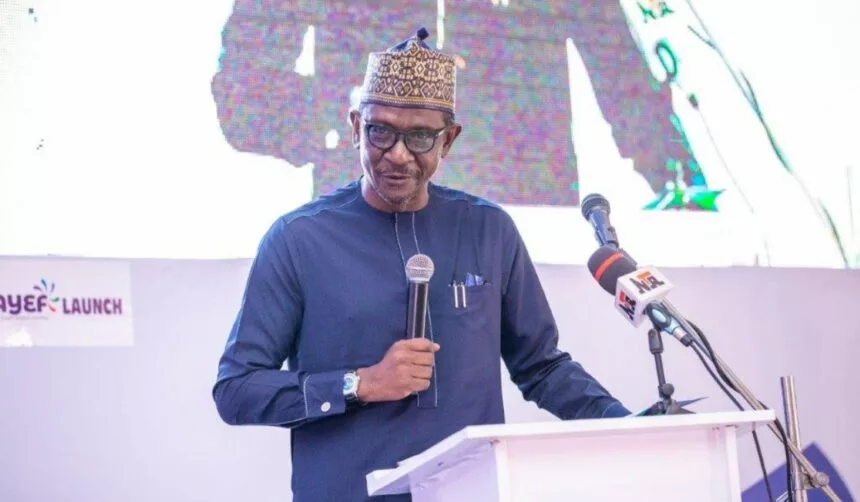

A digital platform to unlock the boundless potential of cocoa in Africa has been launched. The digital platform tagged ‘cocoa connect Africa’ is an initiative of the Nigeria Export-Import Bank (NEXIM). The Managing Director of NEXIM, Abubakar Bello, while speaking at the launch, pointed out that the platform is not for profit making, but to boost trade facilitation and setting standards for traceability. “The platform can be used to educate farmers; it can be used to educate regulators and to pass information on latest developments. We must create awareness for farmers on the latest trends, there is also a need for effective regulation in the value chain”, he said.

Bello explained that the move is to bring every activity of every stakeholder in the cocoa industry and the cocoa ecosystem under one platform. “It is about somebody, who has products and meeting someone, who is interested in the product. It is about connection and market information. We are putting all the stakeholders on the value chain for different commodities, but the one we launched today is for cocoa and we are also doing the same for cashew. We are also doing so for shea. The idea is to have a cluster because today everything is done digitally; why should our trade be lagging behind? We must create a platform for every stakeholder to log in to purchase what they want digitally from their comfort zones”. At Cocoa Connect Africa, we offer more than just a platform; we provide an immersive experience tailored to elevate your journey in the cocoa industry”, he noted.

The Executive Director, Business Development of NEXIM Bank, Stella Okotete, said NEXIM bank had supported cocoa exporters with over $100 billion in the last seven years with all facilities performing and creating jobs for over 7,000 direct and 70,000 indirect jobs for Nigeria. She added that among others, NEXIM created a Small and Medium Exporters Facility (SMEF) to support exporters, stressing that NEXIM had been supporting suppliers by growing their capacities. She commended the young entrepreneurs, who are making impacts in the cocoa value chain and assured them of her support through the bank. She noted that with the recent spike in the prices of cocoa, the bank had opened up its refinancing windows to support exporters with single digit loans. “We are sure that the cocoa exporters will take advantage of the opportunity, because it will help them to reduce the burden of the double digit interest rate. We are ensuring that we will continue to do more”, she said.